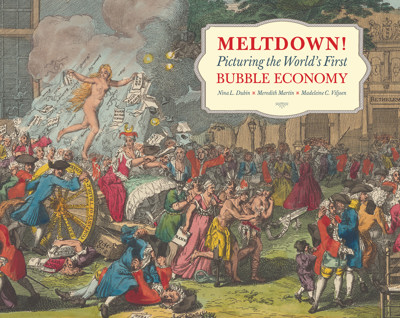

Meltdown! Picturing the World’s First Bubble Economy

Madeleine Viljoen, Meredith Martin, Nina Dubin

- Pages: 157 p.

- Size:300 x 240 mm

- Illustrations:120 col.

- Language(s):English

- Publication Year:2020

- € 50,00 EXCL. VAT RETAIL PRICE

- ISBN: 978-1-912554-51-5

- Hardback

- Available

This book focuses on the depiction of the first international financial crisis following the 1720 collapse of stock market bubbles in England, France and the Netherlands.

"Meltdown! Picturing the World’s First Bubble Economy succeeds brilliantly in introducing the bubbles of 1720 and their iconography to readers who may not be familiar with them while also offering interpretations that enrich specialists’ understanding of the contributions made by visual and material culture to our knowledge of a pivotal moment in economic and world history." (Catherine Labio, in CAA Reviews, 74, 2021)

"May this be a sign of many fruitful analyses to come that consider the intersection of histories of finance, economics and works of paper across a range of geographies and time periods." (Diana Greenwald, in Print Quarterly, XXXIX, 2022, I, p. 81)

Nina L. Dubin is an associate professor of Art History at the University of Illinois at Chicago. Specializing in European art since 1700, she has published widely on the production of art within an economy of risk.

Meredith Martin is an associate professor of Art History at New York University and the Institute of Fine Arts. Specializing in European art of the long eighteenth century, she has published widely on gender and architectural patronage as well as maritime art, mobility, and exchange in the early modern world.

Madeleine C. Viljoen is Curator of Prints and the Spencer Collection at The New York Public Library. Responsible for the Library’s collection of prints and rare illustrated books, she has published widely on early modern printed images, with special attention to the goldsmith-engraver, the reproductive print, and ornament.

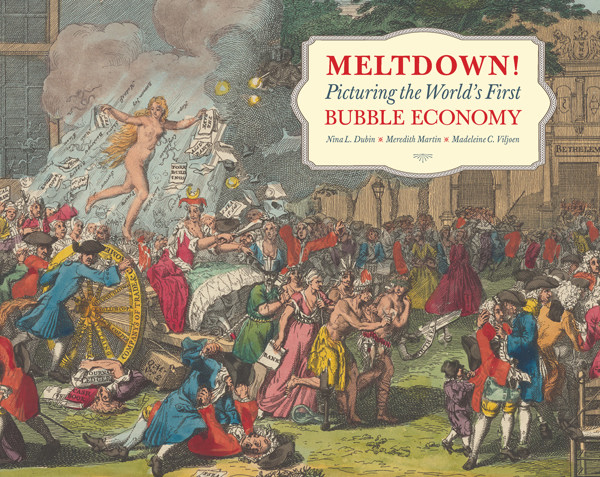

This book tells two parallel stories: one of the spectacular rise and fall of the world’s first bubble economy, and another of the enterprising art industry that chronicled its collapse. The Mississippi and South Sea Bubbles, spawning the invention of French banknotes as well as joint-stock companies built on fantasies of New World trade, imposed on everyday Europeans a crash course in new financial products. In turn, a bubbling print market relentlessly caricatured the meltdown of 1720, offering viewers an entertaining primer on the otherwise bewildering realities of modern economic life. Such satirical works — most notably a Dutch compendium titled The Great Mirror of Folly (Het groote tafereel der dwaasheid ) — helped to demystify the disaster by deploying familiar theatrical characters and tragic-comic motifs. Likening the speculative mania to an infectious disease, and spoofing the “herd behavior” of a money-crazed public, its prints portrayed malevolent traders, hoodwinked investors, and a chorus of heroes and villains both real and legendary, from the rakish financier John Law to the foolish Harlequin to the goddess Fortuna. Three hundred years later, our current moment offers a uniquely fitting vantage point from which to reconsider the significance of the bubbles and of the artworks that channeled the fears and desires they unleashed.